Anantham Retail Private Limited Vs State Tax Officer Madras High Court - Anantham Retail Private Limited Vs State Tax Officer Madras High Court It is seen that there was a surprise inspection in the petitioners showrooms Office and Godown from 14092021 to 16092021 and certain defects were pointed out and thereafter explanation. Notification of New Employee an employer is required to notify the Inland Revenue Board IRB via Form CP22 of the commencement of employment of its employees in Malaysia within one month of the date of commencement of employment.

Tax Treatment On Digital Advertising Provided By A Non Resident

Under Section 2585 of Revenue Regulation RR No.

. This article collates and discusses the provisions in the Income Tax Act 1967 the Act to assist candidates with understanding the more intricate issues relating to interest income and interest expense. Provides the transition procedures for all taxpayers filing tax returns affected by the revised tax rates pursuant to the. 2-98 as amended by RR No.

14-2002 a taxpayer with withholding tax deficiencies will still be allowed to claim the related expense as an income tax deduction as long as the deficiency withholding tax and corresponding penalties are settled during an auditinvestigation or reinvestigation. Generally any person making certain payments such as royalties interest contract payments remuneration to a public entertainer technical and management fees to non-residents is required to remit the tax deducted at an applicable rate ie. If your organisation has done so you can log on here using the credentials provided to.

The tax will see 30 cent per litre added to the price of popular sweetened drinks containing more than 8g of sugar per 100ml. Cessation of Employment an employer is required to notify the IRB of the cessation of employment of an. The withholding tax provision however became effective for sales exchanges and other dispositions after December 31 2017 although as noted below under Notice 2018-08 the withholding provision is suspended temporarily with respect to dispositions of publicly traded partnership interests.

Upon receipt and verification including matching current taxpayer and taxpayer representative records with the information on the submitted Form 4506-T a copy of the original tax return will be mailed as requested. The IRS will provide a copy of a gift tax return when Form 4506 Request for Copy of Tax Return is properly completed and submitted with substantiation and payment. In 2022 Israel also imposed a sugary drink tax due to it adding to their obesity rates.

Prescribes the procedures on the use of Withholding Tax Table on Compensation Income and advises on the change of Creditable Withholding Tax Rate on certain income payments to individuals Digest Full Text WT Table. Some organisations have joined IBFD in an Identity Federation. Single Sign On What is this.

In 2018 several medical. While reading this article candidates are expected to refer where necessary to the relevant provisions of the Act and the Public Ruling 9 of 2015. Withholding tax to the Inland Revenue Board of Malaysia IRBM within one month from the date of paying or crediting.

Soda tax introduced on 1 May 2018. The tax is a matter of public debate in many countries and beverage producers like.

Company Car Benefit Should I Declare It On My Income Tax Filing

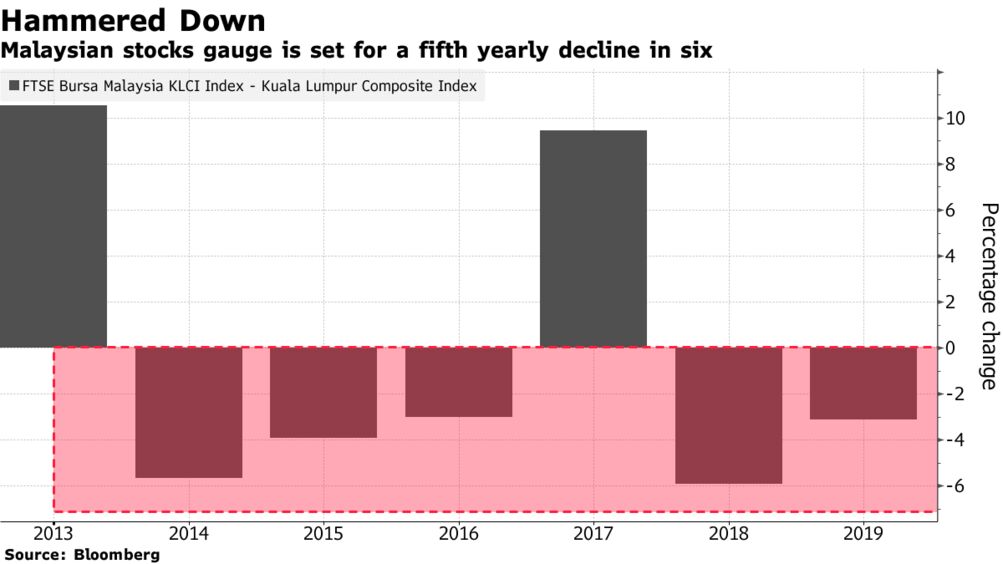

Malaysia Stock Market Is World S Worst Major Market Bloomberg

Healthcare Free Full Text The Role Of Macroeconomic Indicators On Healthcare Cost Html

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

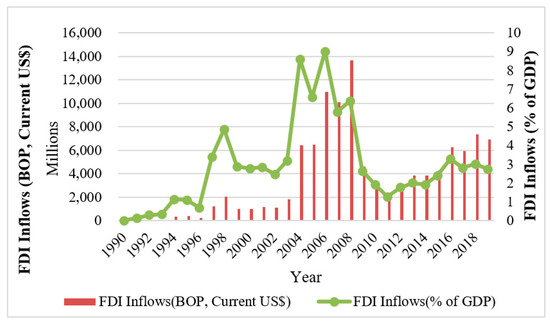

Jrfm Free Full Text Causal Links Between Trade Openness And Foreign Direct Investment In Romania Html

Pdf The Moderating Effect Of Individual Taxpayers Education Level On Ethical Perception And Tax Compliance Behaviour In Peninsular Malaysia

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

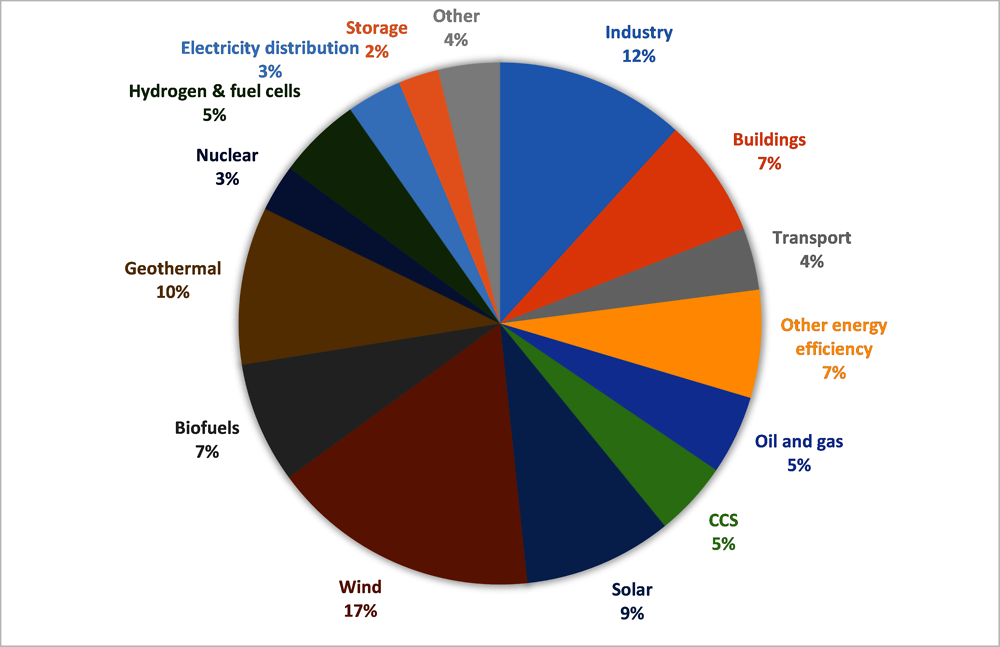

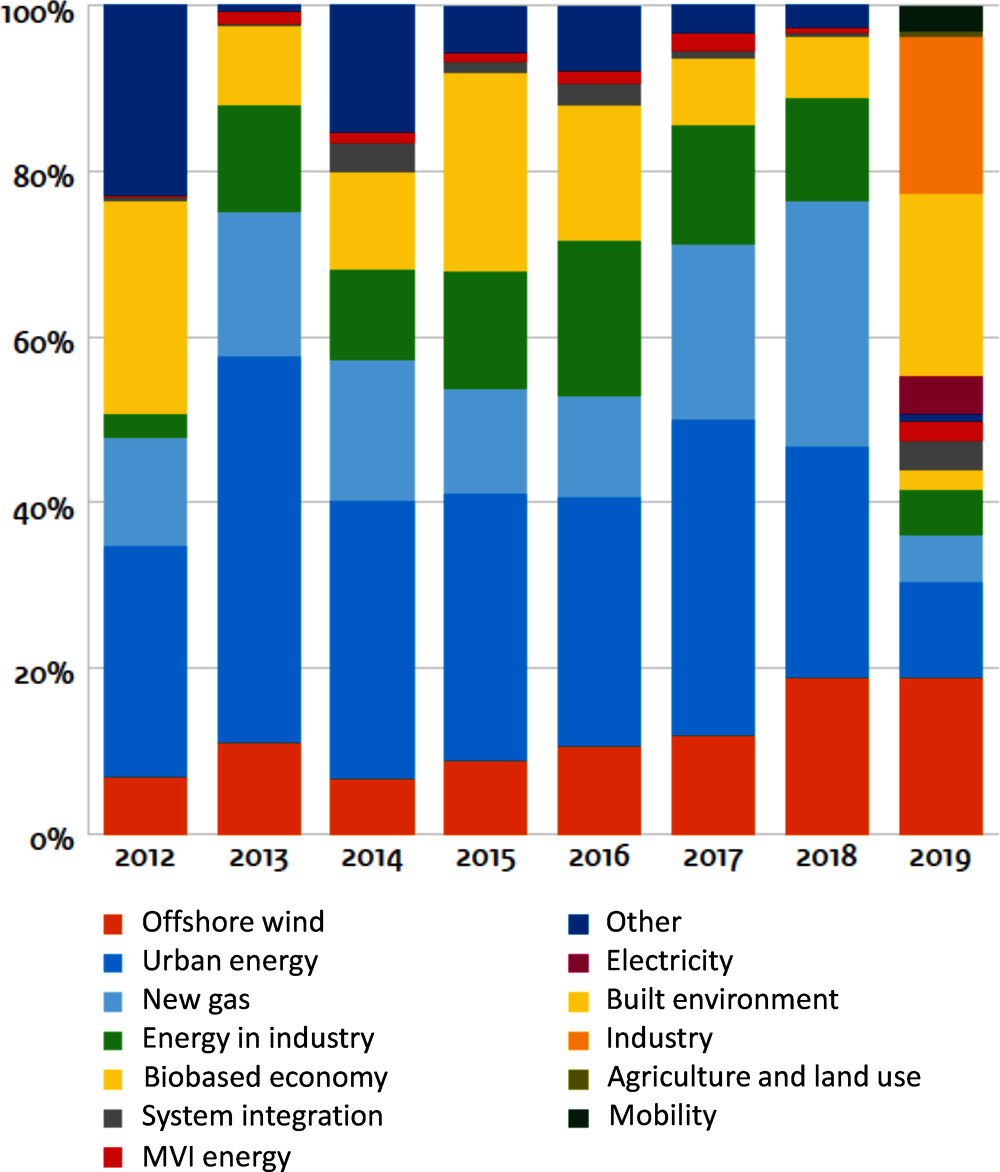

5 Current Policy Package Policies For A Carbon Neutral Industry In The Netherlands Oecd Ilibrary

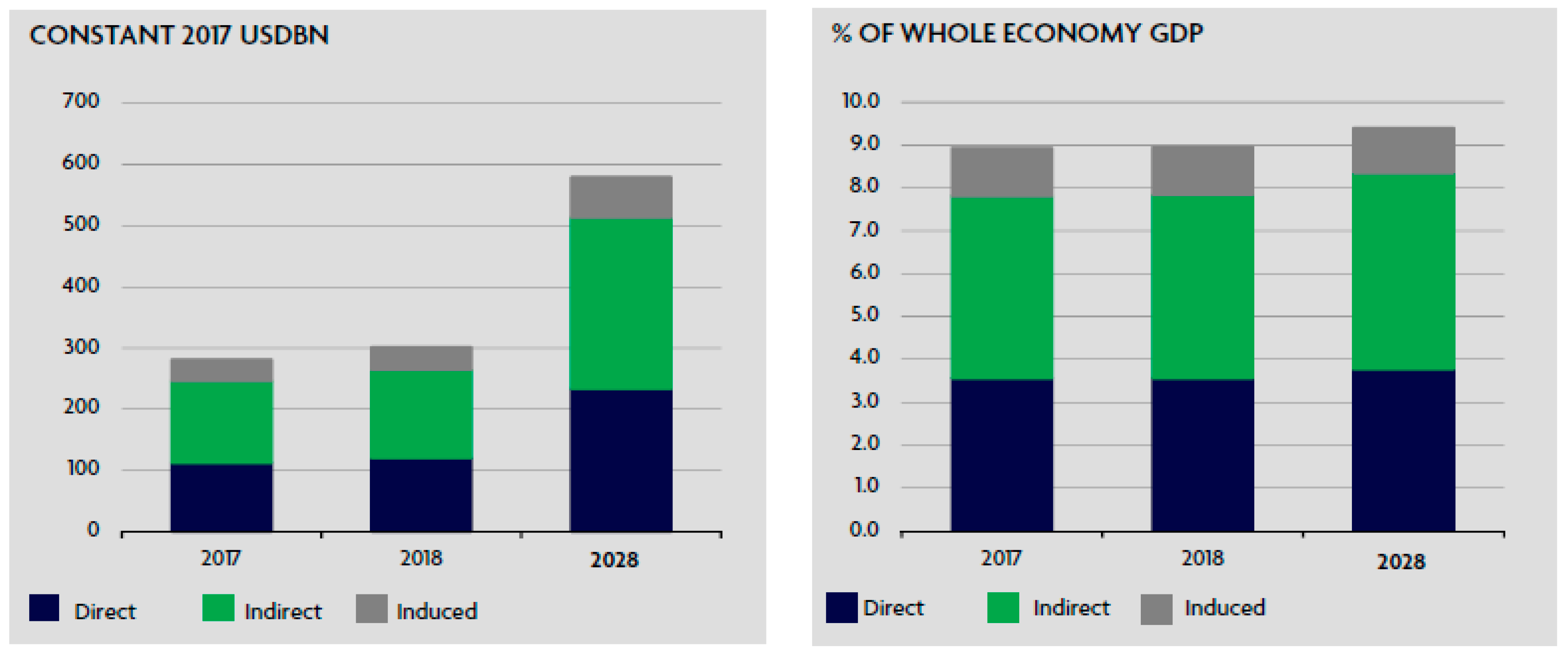

Ijerph Free Full Text The Contribution Of Sustainable Tourism To Economic Growth And Employment In Pakistan Html

Why Esg Is Critical In Asian Fixed Income Investing Pinebridge Investments

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

5 Current Policy Package Policies For A Carbon Neutral Industry In The Netherlands Oecd Ilibrary

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Gross National Income An Overview Sciencedirect Topics

Pdf Effectiveness Of Monitoring Mechanisms And Mitigation Of Fraud Incidents In The Public Sector